What is my insurance agency worth?

Valuation depends on revenue, retention, carrier mix, policy count, and growth potential.

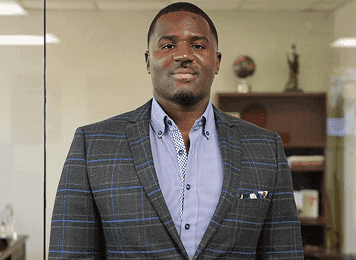

Whether you're planning to sell your insurance agency, acquire one, or explore your options, White Chip Insurance provides the guidance and expert insight needed to make the process smooth, secure, and profitable. Led by industry expert Byron Johnson, our team understands the details that matter most to agency owners and buyers.

Selling an agency isn’t just a financial decision. It’s personal. We help you protect the legacy you’ve built while ensuring you get the maximum value for your book of business.

Below you’ll find answers to some frequently asked questions regarding buying and selling your insurance agency

Valuation depends on revenue, retention, carrier mix, policy count, and growth potential.

Whether you’re selling your agency or looking to acquire one, our process is shaped by the experience of Byron Johnson, a recognized expert in agency growth and acquisitions. Every step is designed to protect your interests and ensure the best possible outcome.

We start with a private discussion to understand your goals, timeline, and agency profile.

We analyze financials, retention, carrier appointments, operational structure, and growth potential to determine realistic market value.

We connect you only with qualified parties who meet your criteria — no wasted time, no unvetted prospects.

Financial verification, book-of-business audits, loss ratio review, compliance checks — we guide you through each step.

From terms to transition planning, we help craft agreements that protect both sides and maximize long-term success.

Once a deal is reached, we assist with onboarding, carrier notifications, staff planning, and client transition to ensure continuity.

Byron Johnson is the CEO and founder of Star Insurance. Byron acquired his 2-20 property & casualty and 2-15 health, life, and annuities license. Byron grew Star Insurance from a one-man operation to a fully staffed insurance agency. Licenses

CSR 4-40 2-15 Life, Health, and Annuities 2-20 Property and Casualty